Every small business owner with a team of workers should learn how to do payroll since it is a crucial requirement. If you have a team of workers, it is necessary that you do payroll every month. Most established businesses usually opt for the services of an expert when it comes to payroll preparation. If you want to cut on your business expenses to maximize profits, you should learn how to do payroll yourself. Handling payroll every month can be a headache, but if you know a few tips, you will not have to worry about hiring an expert to do it. However, you should be keen when doing payroll since mistakes on paychecks can lead to problems with your employees. This article will help you learn a few tips on how you can prepare your business payroll yourself, check it out!

The first step to doing payroll is having your employees complete W-4 forms. W-4 forms are for employees, while W-9 forms are for independent contractors. In the W-4 forms, your employees will get to include all their allowances. It is a way of protecting your employees from paying more tax. Having an EIN number is one way to inform both the IRS and Federal Government about the existence of your business and tax compliance. On the homepage of this website, you will discover more about the steps to take when applying for EIN. EIN is considered as the social security number of your business. View this page to know more about payroll.

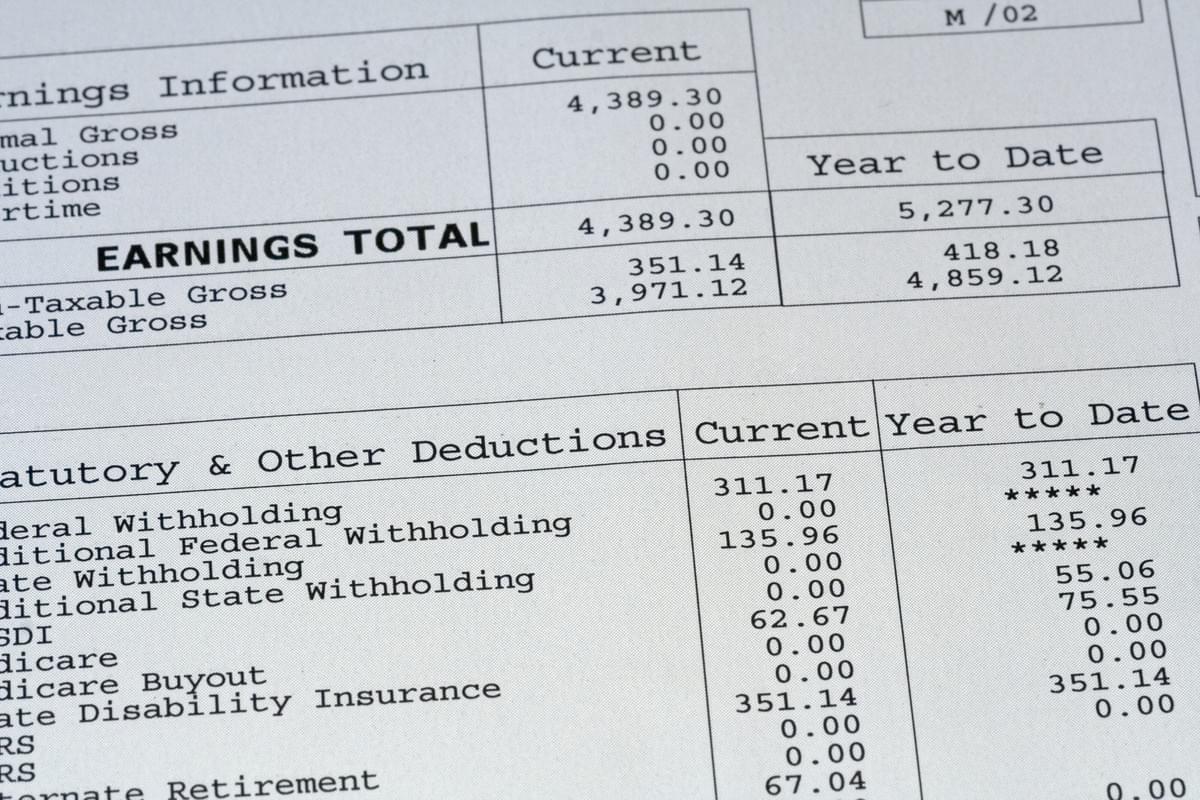

Creating a payroll schedule can help you do your payroll smoothly. This should come after getting all the tax information and EIN. The decision regarding the payment schedule for your business should be influenced by what you are aiming for. Ensure that you have the money ready on the payment date that you choose. If possible, you can consider discussing with your employees about the payment schedule. The part of doing payroll that gives most employers headache is the calculation of gross pay and deductions. It is the stage that you are likely to make a mistake when preparing your payroll. Luckily, there are online tools that you can use to calculate both gross pay and deductions for your employees. On this site, you will discover more about the ways of doing gross pay and deductions calculations.

The last step is filing tax forms. In every payment period, the employer is required to withhold part of the pay as tax. Filling tax forms will ensure that you don’t get into problems with the IRS. Ensure that you do it on time to avoid issues with the IRS. As a business owner, if you want to do payroll yourself, you should follow these steps from now!